Washington Tax Brackets 2025. If you want to know your marginal tax bracket for the 2025 tax year, use our calculator. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

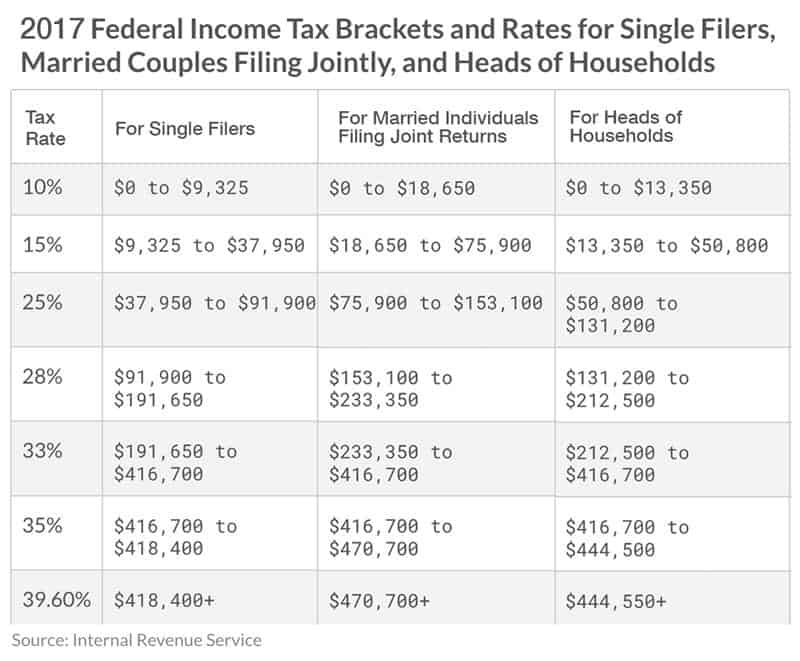

The individual income tax rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% will return to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, with different. The tcja has many provisions that are set to expire (or sunset) at the end of 2025.

T200018 Baseline Distribution of and Federal Taxes, All Tax, The latest annual omnibus liquor bill in utah increases the markup the state charges for spirits, wine, and malt liquor from. At that point, many provisions will revert to 2017 levels, adjusted for inflation.

How tax brackets actually work A simple visual guide Tax brackets, The washington tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in washington, the calculator allows you to calculate. Washington has $11,632 in state and local debt per capita and has a 103 percent.

Tax Rates 2025 2025 Image to u, Calculate your annual salary after tax using the online washington tax calculator, updated with the 2025 income tax rates in washington. The next $35,550 will be taxed at 12%;

How Tax Brackets and the US Progressive Tax System Work, The expiration of the tax law on dec. If you want to know your marginal tax bracket for the 2025 tax year, use our calculator.

What Are Tax Brackets? Modern Wealth Management, 31, 2025, will mean that many americans will be forced to pay anywhere between 1% to 4% more in taxes unless certain provisions are. The irs also increased the standard deduction for individuals and.

Here are the federal tax brackets for 2025, The expiration of the tax law on dec. You pay tax as a percentage of your income in layers called tax brackets.

The Closing Window Of Opportunity For Roth IRA Conversions What I've, There is also no need for a standard deduction. Income tax tables and other tax information is sourced from the washington.

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, 31, 2025, will mean that many americans will be forced to pay anywhere between 1% to 4% more in taxes unless certain provisions are. The 2025 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released.

2025 Tax Brackets And Tax Rate Shani Melessa, An essential aspect of your paycheck is the. The irs also increased the standard deduction for individuals and.

IRS Guidelines Unveiled Navigating Federal Tax Brackets, The individual income tax brackets in 2017, before trump's tax law took effect: Your tax rate is determined by your income and tax filing status.

Use our income tax calculator to find out what your take home pay will be in washington for the tax year.