Irs 2025 Contribution Limits. Understanding these changes can help you maximize your. Key changes for 2025 retirement plan contribution limits.

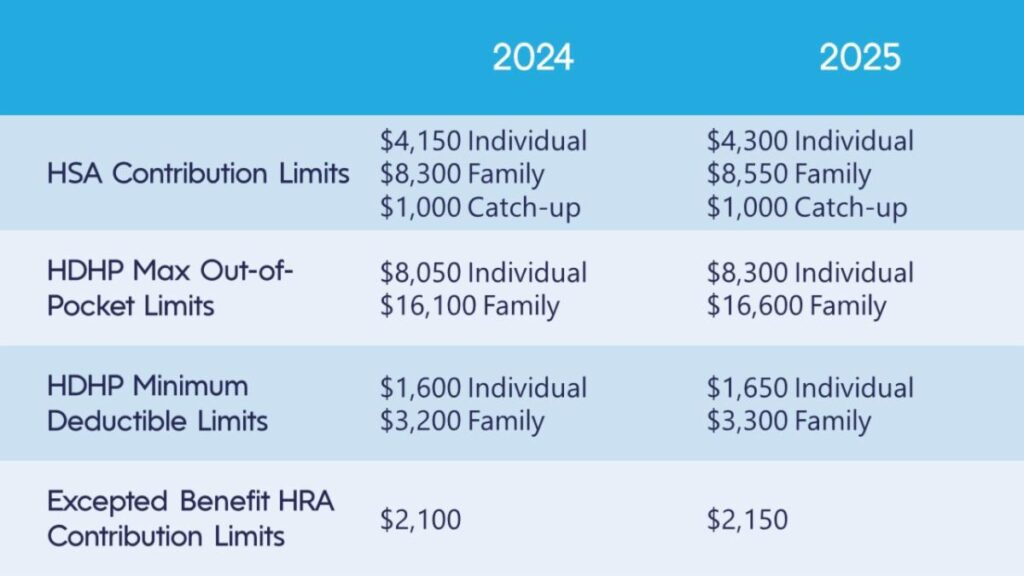

The internal revenue service (irs) has announced the 2025 ira contribution limits will remain unchanged from 2025. In 2025, individuals can contribute up to $4,300 (up from $4,150), while families can contribute $8,550.

2025 Irs 457 Contribution Limits Leia Shauna, While many retirement plan limits will see increases, the adjustments.

2025 Irs 457 Contribution Limits Leia Shauna, Understanding these changes can help you maximize your.

2025 Irs 457 Contribution Limits Leia Shauna, The irs announced 2025 dollar limits on benefits and contributions for qualified retirement plans.

401k 2025 Contribution Catch Up Limit Irs Andrew Nash, The 401 (k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

401k 2025 Contribution Limit Ciel Melina, Hsa contribution limits health savings account (hsa) limits are increasing!

Irs 2025 Contribution Limits Pdf Leah Nash, In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2025.

Irs 2025 Contribution Limits Rubia Ondrea, For example, the maximum annual contribution to a health savings account increased from $4,150.

Irs 401k Contribution Limit 2025 Max Dickens, The irs on friday announced an increase to the amount individuals can contribute to their 401 (k) plans in 2025 — to $23,500, up from $23,000 in 2025.